1

DEC 2018Prospects for 2019, as currently foreseeable – and the need for a “Global Index of New Technology Economic Impact”

Posted by Prabhu Guptara | Uncategorised

THE PROSPECTS FOR 2019 – AND THE NEED FOR AN INDEX OF THE GLOBAL ECONOMIC IMPACT OF NEW TECHNOLOGY

It is clear to every intelligent observer that, in the next 12 months, global economic growth is highly uncertain, dependent as growth always is on two factors (investment and productivity), which can be characeterised at present in the following way:

INVESTMENT

Right now, the gap between returns-on-cash and returns-on-equity has narrowed to the point that many investors have moved to cash.

In the immediately-foreseeable future:

EUROPE faces financial tightening and raised risks because of talk of an end to quantitative easing from the ECB, along with developments in Italy, and the UK’s Brexit now utterly mindbending “non-drama”.

INDIA is a stumbling horse, mainly because it is unclear how the current ruling party (which has been extraordinarily beneficial to its friends) will fare in the 2019 national elections.

CHINA’s government does seem willing to provide further stimulus … to slow down the deceleration of the economy, but not to enable any acceleration of it – at least, that is the only conclusion one can reach given the smoke puffs that emerge occasionally from Beijing: it is impossible to tell what China will do next or even to know what is really going on in the Chinese economy.

By contrast, the situation in the USA is relatively clear: The fiscal stimulus last year effected a short-term kick in the pants whose effect will dissipate over the next few months, and the outcome of the mid-year elections makes more of that sort of stimulus unlikely in the near future: very few American leaders are likely to supprort the inevitable widening of the deficit that will result.

Sooooo … as far as I can see, a recession in earnings will presage a decline in the real economy – pending (or, rather, when that follows!) productivity growth through the widespread application of new technologies.

PRODUCTIVITY

if the prospects of growth due to investment appear poor in 2018, what about the prospects of growth due to increased productivity by the deployment of new technologies?

This is certainly a huge potential growth-ally, given most really impressive new technologies (e.g. AI and robotics, with quantum computing further away) remain merely on the threshold in most areas of business.

How then are you and I to have any sense of how fast – and perhaps even more important, how effectively – new technologies are being adopted?!

Well, there isn’t really any way of doing so at all, at present,

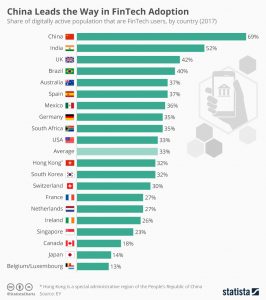

All we have are substantively meaningless charts such as the one at the head of this blog.

Why is that one “substantively meaningless” in terms of any useful indication of productivity increase for the economy as a whole?

First because it doesn’t indicate anything for the globe as a whole, or even for global regions, on indeed even for nations as a whole… because its rating of countries is on the basis of the “the share of Fintech users in the digitally active population”!

The “digitally active population” is ill-defined (is a child of 5 “digitally active”? Is a grandmother of 90 who use her computer only to skype her family “digitally active?).

Not everyone who is “digitally active” is also financially active (and that can mean anything upwards from “occasionally uses a bank or other debit or credit card”!)

In any case, even if 100% of the whole population of a country used fintech, that wouldn’t amount to much if the country concerned were, say, Afghanistan or Zimbabwe.

That is why we urgently need not merely indices such as we currently have, of “fintech adoption”, but a more fully thought-through “Global Index of New Technology Economic Impact” or #IndexOfNewTechGlobalImpact

None of the existing Productivity Indexes (Divisia, Geometric, Malmquist, Solow, Tornqvist, Translog…) do a good enough job of precisely what is needed in the context I have laid out above.

What should an adequate new Index do? It should assess the full impact on the global economy of productivity increases by the adoption of the newest technologies (including but probably not limited to AI, robotics, and quantum computing). Initially, the Index will need to sector after sector, before moving to become genuinely global. Perhaps start with Financial Services, then go on to Logistics, then Manufacturing, and so on.

At present, I can’t find a sufficient number of people interested in creating such an Index.

All offers of collaboration are welcome.