21

AUG 2019Quantum Technologies – the implications for companies

Posted by Prabhu Guptara | Uncategorised

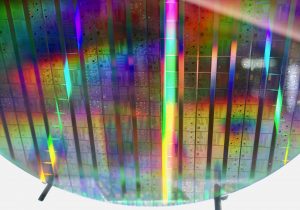

PHOTO BY Steve Jurvetson from Menlo Park, USA; CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=71232867

Companies need to have an overview of the implications of the arrival of quantum technologies.

This is my attempt at summing up my work on all this so far:

1. SECURITY: The largest companies as well as governments are working on protecting themselves from quantum disruption of existing security systems – whether they are working as efficiently and effectively as they should is a different question! But it is not clear to me that less-large companies are doing much to prepare for quantum disruption of their existing security systems. Whether your company is large or not-so-large, if you need (free) help with this matter, in terms of an outline of the sorts of things your company can do, drop me an email and I will send it to you for no charge and no obligation: prabhusguptara@gmail.com

2. PRODUCTS: The largest telecoms companies and other large providers would have been expected to have got into the field by now, but (so far) there are only a very few companies that are involved – for good reasons, as well as not-so-good reasons. What that means is that less-large companies (if they have the will, and a 5-10 year horizon) can get into the field for a relatively small budget.

3. SERVICES: Very few companies are offering services in the field of quantum technologies, so this is also a field which companies (large and not-so-large) can start eyeing, if they have a 3-5 year horizon.

4. INVESTORS: quantum technologies are a field about which you certainly do *NOT* need to inform yourself if you are a short-term investor. I expect those who are NOT short-term investors to include governments, large companies, pension funds, reinsurance and insurance companies, but also *individual* investment analysts if they expect to work, of if their investment horizon is, beyond the next 3 to 5 years

5. EXECUTIVE DEVELOPMENT: If quantum computing is not already part of your curriculum, then you are programming your organisation for obsolescence in something like 5 years. If you want to avoid such obsolescence, do ensure that you include at least the following: the basics of quantum physics, an update on the current state of development in quantum technologies, and a discussion of the implications for your company.

6. RECRUITMENT INTERVIEWS: Do you already establish whether ALL potential recruits (including those who are intended NOT to work in IT) are at least somewhat up to date on quantum technologies? If not, do ensure that your company trains everyone involved with recruitment for your company both in the minimum they need to know, and for the best ways of checking on the level of knowledge and awareness of potential recruits.

7. TRAINING: Are basic modules on quantum technologies (quantum physics, and an update on the current state of development in quantum technologies) included in your training programmes for every recruit? Let me emphasise that that includes not only everyone working, and expected to work, *in* IT, but also everyone working, and expected to work, *outside* IT.

8. BUSINESS PROCESSES: Though some companies have indeed worked out the security-related implications of quantum technologies for each business process, I am concerned that very few seem to have done thought through the implications for each business process itself. The least your company can do is some scenario-planning in the light of developments in quantum technologies, given that it will probably take your company at least 3-5 years to implement changes in key business processes.

9. GOVERNANCE: There is huge discussion about relatively unimportant things like diversity in Boards, when essential developments such as AI and quantum technologies are being ignored. Adequate attention at Board level means asking at least the following:

9a. Do Board members have regular briefings (at least once a year) on latest developments in what I call “horizon technologies”? These include quantum technology and AI, though of course companies in different fields need to keep other specific business-portfolio-relevant “horizon technologies” on their radar.

9b. Has the Board created a mechanism for ensuring that there is an up to date dashboard of the portfolio of technologies in the company which are fully-integrated, those which are partially-integrated, those which are experimentally-integrated, those which are being evaluated for integration, and those which are being watched on the horizon? Is the key person responsible for each of these named, with at least 3 successors in line for each? Are the budgets for each of these adequate?

9c. How does the Board currently benchmark against key competitors the company’s level as revealed by the dashboard?

9d. Is the dashboard regularly vetted (at least every 6 months) by a qualified external board of experts?

9e. Is “technology-competence” adequately defined for members of the Board, members of the top Executive Committee, other senior executives, mid-level executives, and tech professionals? Are these definitions regularly vetted (at least every 6 months) by a qualified external board of experts? Are Board members and other members of the company regularly assessed in relation to the definitions of competence required at those levels? Are proper incentives in place to encourage company executives to keep up with the increasing levels of competence required? Are appropriate training and development opportunities in place?

I’ve probably missed at least one or two things in my summary and overview above.

Happy to have corrections/ amendments/ additions/ caveats/ questions. Best via an email to me: prabhusguptara@gmail.com